Are ‘Higher for Longer’ Interest Rates Back?

The path suddenly isn’t so clear for the Fed and the bond market.

Forget about an interest rate cut in March, and maybe May too. Unexpectedly strong economic data has investors scrambling to recalibrate their expectations for the Federal Reserve’s next move. According to John Briggs, global head of desk strategy at NatWest Markets, investors still anticipate Fed cuts at some point, “but they’re questioning their timing. They’re questioning the pace.”

That change has had profound implications for the bond market and in turn stocks. Yields are once again ticking up as the bond market stalls in the wake of the blistering rally in fixed income that closed out 2023, when the Fed’s “higher for longer” philosophy seemed to disappear in the rearview mirror. That outlook was good news for investors in search of yield, but it also took a toll on equity and bond prices.

Yields on the 10-year Treasury note peaked just under 5.00% in October before falling back down to 3.97% by the end of December as investors began to anticipate rate cuts. Until very recently, yields had bounced between that low and a high of around 4.2%.

But now the momentum is shifting again. The yield on the 10-year note hit 4.32% this week, its highest level since mid-November. After a strong 2023, the Morningstar US Core Bond Index is down 1.83% since the beginning of the year and 1.66% over the past month. “We’re in this in-between,” Briggs says, “where it’s ‘not quite as low as we thought’ for longer.”

In general, analysts expect yields to land somewhere between the highs we saw before the financial crisis (when yields above 4.5% or 5.0% on 10-year Treasuries weren’t at all out of the ordinary) and the rock-bottom lows of the years before the pandemic (when 10-year yields rarely cracked 3.0%). Strategists at Wells Fargo are forecasting that the 10-year will end 2024 with a yield of 3.60%, while analysts at Northern Trust are projecting a range of 3.75%-4.25%.

Long-Term U.S. Treasury Yields

A Soft Landing Is No Longer Seen as a Certainty

It wasn’t all that long ago that bond futures markets were pricing in between six and seven rate cuts for 2024, with the first expected to come as early as March, even as the Fed itself projected cuts of half that magnitude. Expectations are a different story today.

Jack McIntyre, fixed income portfolio manager at Brandywine Global, explains that “What we’re seeing now is this kind of wrestling” as the market struggles to come to terms with the Fed’s view on the likely path for rates.

In the middle of 2023, investors steeled themselves for a prolonged period of high rates after one of the most aggressive monetary-policy-tightening cycles in Fed history. Then, in the third quarter of last year, sentiment shifted dramatically to expectations of significant rate cuts in 2024. A looser policy makes it cheaper for companies to do business and stimulate economic growth, and it tends to boost the prices of stocks, bonds, and other financial assets.

But a recent spate of hot economic data, including January’s blockbuster jobs and inflation reports, has thrown cold water on that optimistic outlook, and increasingly hawkish commentary from central bank officials has stoked investor concerns.

As of Feb. 16, the bond futures markets—where traders place bets on the direction of interest rates—saw a 10.5% chance of the Fed cutting rates by 0.25% at its March meeting, according to the CME FedWatch Tool. A month ago, on Jan. 16, markets were pricing in a 63.1% chance of a quarter-point rate cut. Over the past week, the predicted probability of the first cut coming at the May meeting has fallen from 52.2% to just shy of 32.4%. There’s a 51.6% chance that the first cut will come in June.

Expectations for May 2024 Federal Reserve Meeting

Bond traders now expect four cuts in total in 2024, down from the six expected at the start of the year. The hot economic data also calls into question the possibility of a rare soft landing, which until recently was seen almost as an inevitability. That change is part of “what’s spooking the bond market today,” McIntyre says.

Investor Interest Fades In Long-Term Bonds

The strong inflows into the bond market over the past month are also in play. In January, as bond investors looked ahead to lower rates and inflation, many rushed to lock in longer-duration investments (bonds with maturities of 10 years or more).

“There has been healthy supply to meet this robust demand, with almost $200 billion of investment-grade bond issuance in January, with the busiest day of trading in history occurring Jan. 31,” wrote Katie Nixon, chief investment officer at Northern Trust Wealth Management, in a recent note.

All that bond-buying in January pushed yields lower and prices higher. “You had this overall thematic move into fixed income,” Briggs explains. However, that was followed in February by a major reset in expectations that Fed cuts may be coming later. That may have reduced demand for bonds and helped send yields higher recently.

Lawrence Gillum, chief fixed income strategist at LPL Financial, adds that while demand may be shifting, it hasn’t cratered by any means, even in the wake of January’s strong inflows. He points out that the largest-ever 10-year Treasury auction occurred just last week. “There is still demand for duration out there,” he says.

Are We Back to Interest Rates Being Higher for Longer?

Last fall, investors had just come to terms with the “higher for longer” regime for interest rates. Today’s rate environment may prompt feelings of déjà vu, but analysts say there are a few critical differences now.

For one, progress on inflation means real policy rates are meaningfully tighter than they were six months ago. “It’s not where the Fed wants it to be,” says Gillum, “but it’s headed in the right direction.” Rates may end up higher than what the market originally priced, says McIntyre, but it’s less likely they’ll end up higher than what the Fed is anticipating.

Treasury Yield and Federal-Funds Rate

What’s Ahead for Bonds?

Some analysts say the bond market’s recent repricing, while painful in the short term, may not be the worst news for investors. “Markets were overly aggressive with pricing in rate cuts,” Gillum says. As a result, he believes the recent backup in yields “is warranted … now markets are fairly priced.”

Of course, that doesn’t mean there aren’t risks on the horizon. The most pressing one is that inflation could remain too high for the Fed’s liking. “Inflation is the nemesis of bond markets,” McIntyre says. Briggs adds that markets aren’t priced for a higher-inflation environment where the central bank doesn’t end up cutting rates: “That’s a major problem for everything.”

The Good News

Fortunately for bond investors, a world without rate cuts isn’t the base case for most analysts. “You have had a lot of progress on inflation since last fall,” Briggs says, and the outlook for fixed income is still good over the next 12 months. And if yields do stay higher than expected, it won’t be all bad news.

“The value proposition for fixed income isn’t falling rates,” Gillum says, “it’s high income. Even if rates don’t fall from current levels, we think fixed income is still a pretty attractive allocation. You’ll still collect your coupons and your organic price appreciation.” And if yields do come down, he adds, bond investors can expect some price appreciation on top of that.

Until we have more clarity on inflation, McIntyre says, investors can look to the bond coupon to offset any volatility and price depreciation in the market. History is on investors’ side, too. “Historically, when the Fed is cutting rates—particularly after tightening rates—Treasuries do very well the vast majority of the time,” he adds.

For the Trading Week Ended Feb. 16

- The Morningstar US Market Index fell 0.3%.

- The best-performing sectors were energy, up 2.35%, and basic materials, up 2.30%.

- The worst-performing sector was technology, down 1.95%.

- Yields on 10-year U.S. Treasury notes rose to 4.30% from 4.17%.

- West Texas Intermediate crude prices rose 2.47% to $79.17 per barrel.

- Of the 841 U.S.-listed companies covered by Morningstar, 502, or 60%, were up, four were unchanged, and 335, or 40%, were down.

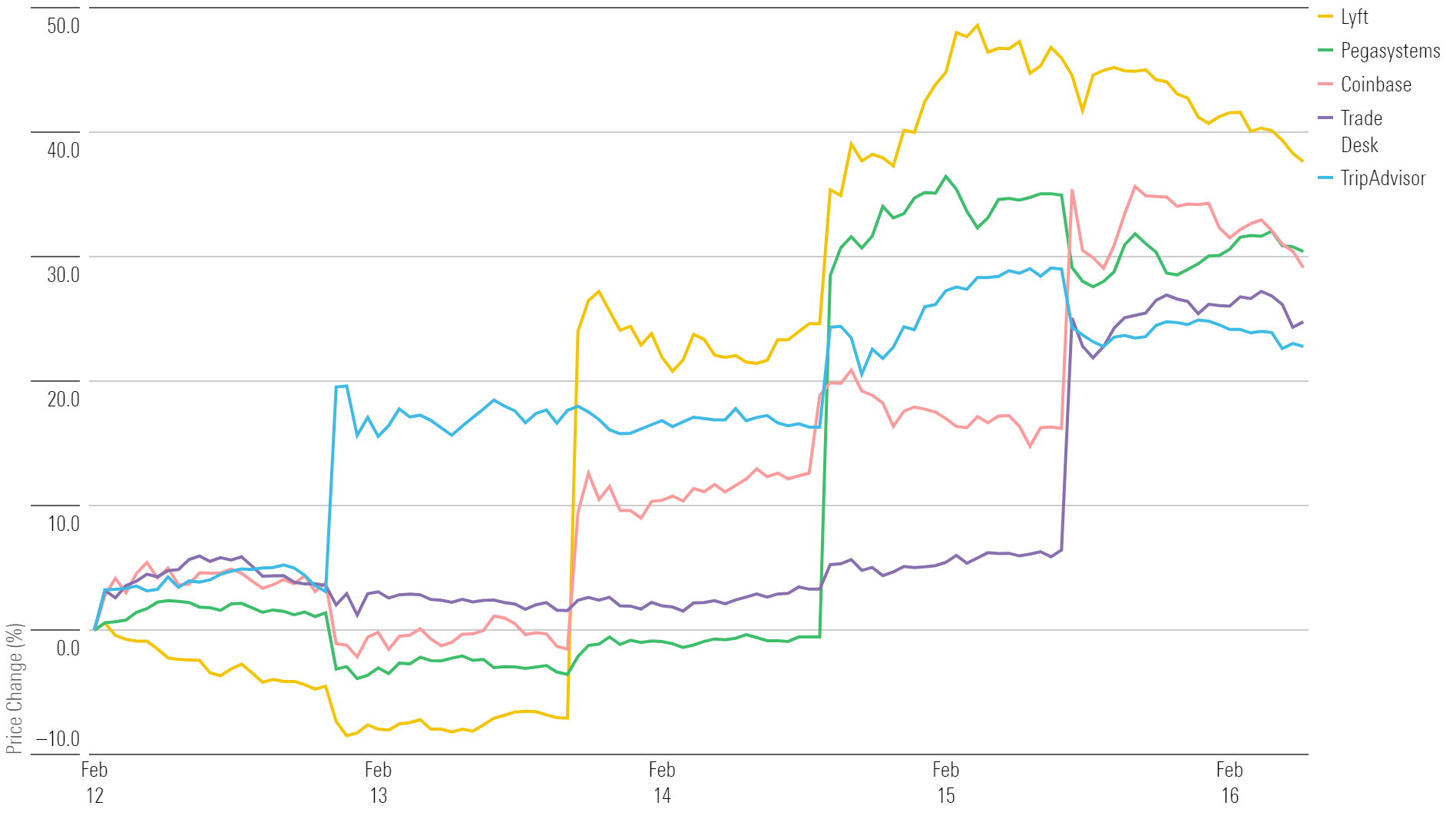

What Stocks Are Up?

Lyft LYFT, Pegasystems PEGA, Coinbase COIN, Trade Desk TTD, and TripAdvisor TRIP.

Top-Performing Stocks of the Week

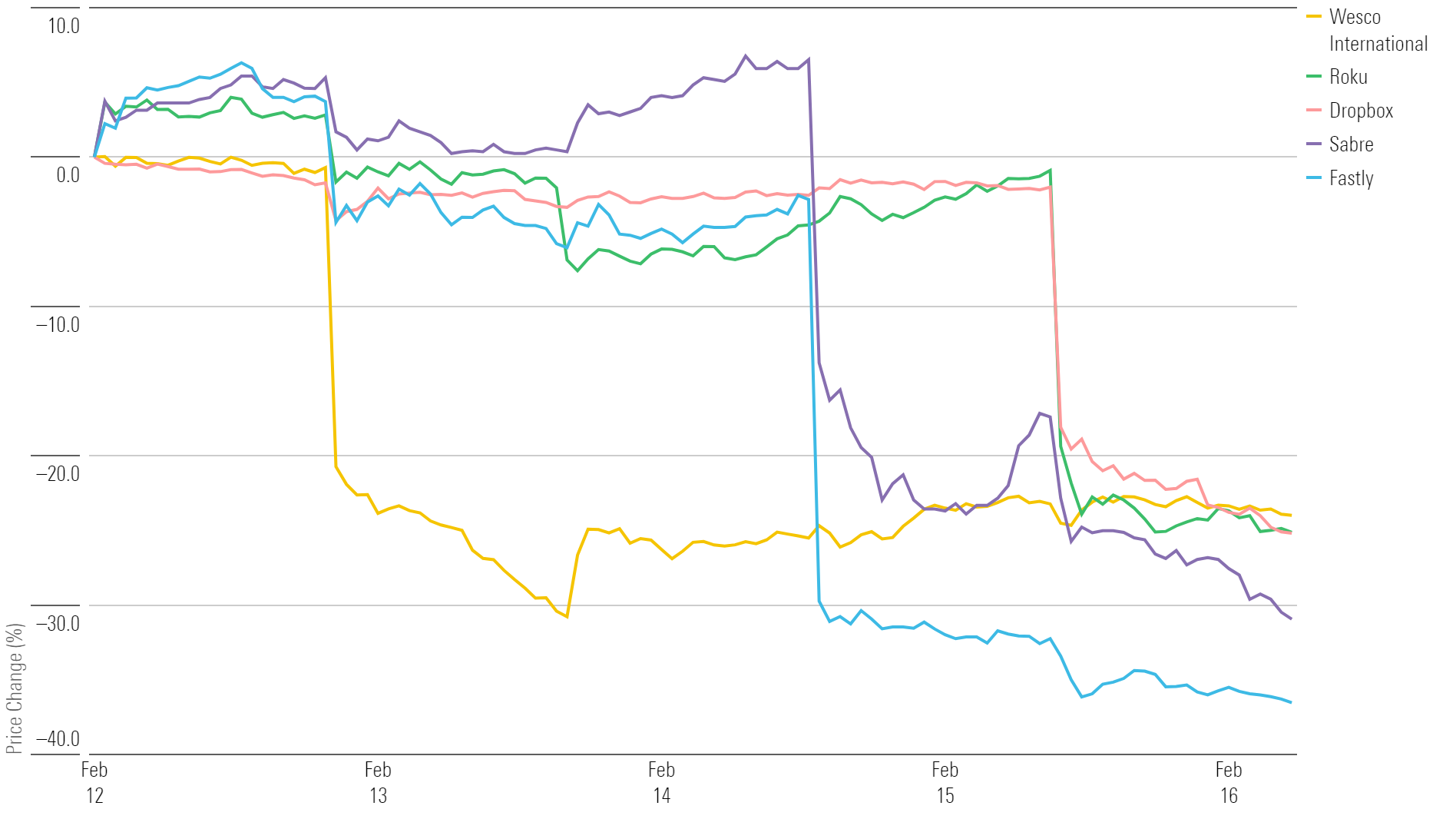

What Stocks Are Down?

Fastly FSLY, Sabre SABR, Roku ROKU, Wesco International WCC, and Dropbox DBX.

Worst-Performing Stocks of the Week

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)